Previous Issues Volume 7, Issue 1 - 2024

Economics of Diabetes Mellitus and Pancreas Transplantation

Rainer WG Gruessner1,*, Angelika C Gruessner2

1Professor of Surgery, State University of New York (SUNY)–Downstate, USA

2Professor of Medicine, State University of New York (SUNY)–Downstate, USA

*Corresponding author: Rainer WG Gruessner, MD, PhD(GE), MHA, Professor of Surgery, State University of New York (SUNY)–Downstate, USA, Email: [email protected].

Received Date: February 01, 2024

Published Date: February 14, 2024

Citation: Gruessner RWG, et al. (2024). Economics of Diabetes Mellitus and Pancreas Transplantation. Mathews J Diabetes Obes. 7(1):19.

Copyrights: Gruessner RWG, et al. © (2024).

ABSTRACT

Information on economic and financial data of pancreas transplantation in the United States is scarce and usually outdated by the time it is published. This applies to organ acquisition costs, transplant hospitalization costs, and follow-up costs. Data appears to be more transparent and forthcoming from CMS than from private health insurance providers. In general, the following conclusions can be drawn regarding the economic and financial aspects of pancreas transplantation: (1) organ acquisition costs are too high, a national database to compare rates between individual OPOs does not exist, and attempts to regulate organ acquisition costs have failed; (2) reimbursement for physician services, and to a lesser degree for hospital and clinic services, is too low; and (3) the decrease in pancreas transplant numbers from 2004 to 2015 can be explained, at least in part, by the fact that many pancreas transplant programs lost money, which created institutional disincentives and, in turn, resulted in a decrease in the number of pancreas transplants between 2004 and 2015 nationwide.

Keywords: Pancreas Transplantation, Economy of Pancreas Transplantation, Finances, CMS, Medicare, Private Health Insurance Providers, (Solid) Organ Acquisition Charge, OAC, Transplant Cost.

INTRODUCTION

A common national dataset on hospital, procurement, physician, and drug charges, actual costs and reimbursement still does not exist [1]. Financial and insurance data remain non-transparent and published data, mostly available through the Internet these days, is outdated, incomplete or non-comparable. Hence, it is not surprising that the scientific literature lacks detailed analyses about the economy of pancreas transplantation.

DIABETES IN THE UNITED STATES–THE SCOPE OF THE PROBLEM

The number of U.S. citizens affected by all types of diabetes is staggering and mirrors the global health care crisis caused by this disease.

As we have entered the third decade of the 21st century, a total of 34.2 million people in the United States have diabetes (10.5% of the US population): 26.9 million people have been diagnosed with the disease and 7.3 million people (21.4%) are undiagnosed [2].

The rates of diagnosed diabetes in adults by race/ethnic background are: 7.5% of non-Hispanic whites, 9.2% of Asian Americans, 12.5% of Hispanics, 11.7% of non-Hispanic blacks and 14.7% of American Indians/Alaskan Natives [2].

Nearly 1.6 million Americans have type 1 diabetes, including about 187,000 children and adolescents. Each year, 1.5 million new cases of diabetes are diagnosed [2,3].

In addition, 88 million people aged 18 years or older have prediabetes (34.5% of the adult US population) [3].

Diabetes was the seventh leading cause of death in the United States in 2017 based on 83,564 death certificates in which diabetes was listed as the underlying cause of death. In 2017, diabetes was mentioned as a cause of death in a total of 270,702 certificates. It appears that diabetes is underreported as a cause of death. Studies have found that only about 35% to 40% of people with diabetes who died had diabetes listed anywhere on the death certificate and about 10% to 15% had it listed as the underlying cause of death [2]. Diabetes remains a major cause of blindness, kidney failure, heart attacks, stroke and lower limb amputation in the United States and worldwide [2-4].

COSTS OF DIABETES

In the United States, the cost of care for people with diabetes now accounts for one in four health care dollars spent [5].

According to the American Diabetes Association (ADA), the total estimated 2017 cost of diagnosed diabetes is $327 billion which includes $237 billion in direct medical costs and $90 billion in reduced productivity [6]. Diabetes mellitus is the most expensive chronic disease in the nation. After adjusting for inflation, costs have increased since 2012 due to both an 11% increased prevalence of diabetes and a 13% increase of the cost per person with diabetes [6]. The continuing increase in total direct costs of diabetes from $116 billion in 2007 and $176 billion in 2012 to $237 billion in 2017 is not only striking but almost impossible to sustain in the future.

The largest components of medical expenditures are [2]:

- Hospital inpatient care (30% of the total medical cost)

- Prescription medications to treat complications of diabetes (30%)

- Anti-diabetic agents and diabetes supplies (15%)

- Physician office visits (13%)

Indirect costs of diabetes include [2,7]:

- Increased absenteeism ($3.3 billion)

- Reduced productivity while at work ($26.9 billion) for the employed population

- Reduced productivity for those not in the labor force ($2.3 billion)

- Inability to work as a result of disease-related disability ($37.5 billion)

- Lost productive capacity due to early mortality ($19.9 billion)

People with diagnosed diabetes (all types of diabetes) incur average medical expenditures of $16,752 per year, of which about $9,601 is attributed to diabetes [8].

Of note, total per-capita health care expenditures for diabetes are higher among men than women ($10,060 vs. $9,110). They are also higher among non-Hispanic Blacks ($10,470) and among non-Hispanic whites ($9,800) and lower among Hispanics ($8,050). Compared to non-Hispanic whites, per capita hospital inpatient costs are 23% higher among non-Hispanic Blacks and 29% lower among Hispanics. Non-Hispanic Blacks also have 65% more emergency department visits than the population with diabetes as a whole [8].

In a large, retrospective, observational study of 181,423 pediatric and adult patients with type 1 diabetes mellitus (T1DM), diabetes-related costs totaled nearly $800 per month. Pharmacy costs contributed to over half of diabetes-related costs [9].

Herman et al. noted that over 30 years, DCCT (diabetes control and complications trial) intensive therapy cost $127,500 to $181,600 more per participant than DCCT conventional therapy, and modern intensive therapy cost $87,700 to $409,000 more per individual than modern basic therapy [10]. However, excellent glycemic control averted as much as $90,900 in costs from complications and added ~1.62 quality-adjusted life-years (QALYs) per participant over 30 years [10].

The total annual cost of managing an adult with T1DM is significantly higher than that of an adult with T2DM. Joish et al. showed that when propensity scores were used to match 10,103 patient pairs from T1D and T2D cohorts, the T1DM cohort had significantly higher mean total costs than the T2DM cohort ($18,817 vs. $14,148 PPPY [per-patient per-year]; P < 0.001) [11].

On average, people with diagnosed diabetes have medical expenditures approximately 2.3 times higher than what expenditures would be in the absence of diabetes [12].

In addition, diabetic patients visit physician offices, hospital outpatient departments, and emergency rooms more frequently. And, they are more likely to be admitted to the hospital, causing reduced productivity and increased short- and long-term disability [2,5,7,8].

In a Markov state/transition simulation model consisting of 1,630,317 patients with type 1 diabetes and an equal number of patients without type 1 diabetes, the difference in lifetime costs was estimated at $813 billion (95% confidence interval: $682-$1037 billion). This study stressed the ‘high burden of illness compared with patients without type 1 diabetes and the need for significant investment in research and development of novel treatments for type 1 diabetes’ [13] - which should include beta-cell replacement therapies such as pancreas transplantation.

Most of the cost for diabetes care in the U.S., 67.3%, is provided by government insurance (including Medicare, Medicaid, Children’s Health Insurance Program [CHIP] and the military). The rest is paid for by private insurance (30.7%) or by the uninsured (2%). Hence, taxpayers end up footing most of the bill for diabetes treatments [14,15].

People with diabetes who do not have health insurance have 60% fewer physician office visits and are prescribed 52% fewer medications than people with insurance coverage—but they also have 168% more emergency department visits than people who have insurance. This alarming trend is yet another reason for establishing universal health coverage in the United States as it is already standard in most Western countries [12].

These numbers and estimates also highlight the financial burden that diabetes imposes on society and the need for cost containment.

There is some glimmer of hope. Between 2012 and 2017, the fraction of annual per capita health care expenditures for a person with diabetes that were attributed to institutional care has decreased from 50 to 36% [16]. It appears that the shift of expenditures from inpatient settings to ambulatory care demonstrates progress in controlling chronic complications related to diabetes and points to potential targets for intervention to reduce ambulatory costs [16]. However, over the same time interval (2012-17), the percentage attributed to outpatient services other than medications and supplies increased slightly (from 23 to 26%) and that attributed to outpatient medications and supplies increased dramatically (from 27 to 38%). The largest increase occurred in expenditures for insulin [6,16].

Insulin is used by an estimated 8.3 million people to control their diabetes. Insulin costs, before accounting for any rebates or discounts, comprise an estimated $48 billion (20 percent) of the direct costs of treating diabetes; after rebates, insulin accounts for 6.3 percent of costs. Between 2012 and 2018, the price of available insulin increased 14 percent annually, on average, and in 2016 insulin accounted for 31 percent of a Type 1 diabetic’s health care costs, up from 23 percent in 2012 [14,17].

According to the nonprofit Health Care Cost Institute (HCCI), the cost of insulin for treating type 1 diabetes in the United States nearly doubled over a five-year period: from $2,864, on average, in 2012 to $5,705 in 2016 [18].

Because patients’ out-of-pocket costs are typically based on list price, their expenses have risen substantially despite the decrease in net price for many of the most commonly used insulin products over the past several years [14].

One fourth of diabetic patients are no longer able to afford their prescribed treatment plans and/or ration their supply, which can be dangerous and potentially fatal. This worrisome concern and urgent calls to action [19,20] – at a time when we celebrate the 100th anniversary of insulin - has gotten the attention of the U.S. government and will hopefully be addressed in the near future to avoid preventable deaths [14,21,22].

If the trends of the past decade continue, gross insulin costs in the United States could reach $121.2 billion in total spending (or $12,446 per insulin patient) by 2024 [14].

The rising cost of insulin has already an impact on both patients and society as a whole and will be further accentuated in years to come by the growing utilization and cost of diabetes technology [23].

The overall financial outlook on cost containment of diabetes remains grim and underlines its stance as a global health crisis. While changes in the total economic burden of diabetes in 180 countries worldwide are projected, it is estimated that the global cost of diabetes will increase from $1.3 trillion in 2015 to between $2.1 and $2.5 trillion in 2030 [24]. As life expectancy in diabetic patients continues to increase, so do the rates of secondary complications. In a large German population with of type 2 diabetic patients, the costliest complications were end-stage renal disease (ESRD), lower-extremity amputations, and acute cardiovascular events [25]. Notably, acute events, often accompanied by hospitalization, cause a marked increase in costs that later decline but do not return to pre-event levels. For example, new onset of ESRD in a 60- to 69-year-old man is estimated to cost 34,547 euros in the year of the event and 24,662 euros in each subsequent year. Conversely, given the positive effects of pumps and continuous glucose monitors (CGMs) on T1DM health outcomes, the possibility exists that short-term costs are offset by future savings [23].

Riddle and Herman concluded in their comment to the ADA’s article on the economic costs of diabetes that “for people with known diabetes, interventions targeting specific groups should be considered. The evidence that preventable hospitalizations and reduced workforce productivity due to diabetes occur most often among young adults suggests a need for greater attention to this age-group.” [16]. Unfortunately, the authors do not even mention pancreas or islet transplantation as preventive solutions to these issues in ‘young adults’. After all, only successful transplants result in glycemic control, prevention (of progression) of diabetic complications and reintegration in the workforce [26]. Hence, a successful pancreas transplant contributes to cost containment of diabetes and its complications, avoids unintended harms due to intensive insulin regimens, reduces hospitalizations and may increase work productivity.

COSTS OF PANCREAS TRANSPLANTS

A detailed review of the literature on the economics of pancreas transplantation produced only few studies related to the cost-effectiveness of pancreas transplantation [27,28]. Those studies suggest that transplant center reimbursement for pancreas transplantation has been an issue since the procedure began to increase in numbers and gain traction clinically starting in the 1980s and 1990s [29].

Transparent, national data regarding the costs of a pancreas transplant are not available. Non-transparency is confounded by the facts that (1) detailed hospital/institutional data regarding actual costs vs billed costs vs payments/reimbursement is usually not made public, (2) contracts with insurance providers are usually kept confidential and (3) if some data is made available, it is usually outdated.

For those reasons, only (wide) ranges of cost are available [30]:

In 2017, the United Network for Organ Sharing (UNOS) put the average total cost of a pancreas transplant at $289,400, including procurement, hospital admission, physician fees, and immunosuppressive drugs [31].

The National Kidney Foundation estimated that a pancreas transplant costs $125,800, including the cost of the evaluation, procedures to obtain the donated organ, hospital charges, physician fees, follow-up care and immunosuppressive drugs [32].

Milliman found that the U.S. average cost in 2017 for a pancreas transplant was $347,000 (vs $275,000 in 2008) including evaluation costs, retrieval, preservation and transportation of the pancreas, hospital transplant admission, and post-transplant outpatient visits [33].

Lacking conclusive national cost data, it is not surprising that estimates for patients without health care, the total cost of a pancreas transplant can range widely depending on the hospital, but typically falls between $125,000 and nearly $300,000 or more. However, many hospitals offer discounts of 30% or more to uninsured/cash-paying patients, but even this data is usually not made public [30].

The most comprehensive data analyses regarding the costs of a pancreas transplant in the U.S. are the Milliman and CMS/SRTR reports.

Milliman, Inc., a global consulting and actuarial firm released in 2020 its triennial report on the estimated costs of U.S. organ and tissue transplants [34]. The 2020 report covers billed charges and per-member-per-month (PMPM) estimates from 30 days prior to 180 days after admission for (pancreas) transplantation. The report includes billed charges for follow-up after discharge (up to 180 days after admission) and outpatient immunosuppression and other drugs. Billed charge estimates for procurement and hospital services were based on 2017 and prior state hospital data. Trends to 2020 were projected and the state-specific data to a national average basis was normalized using Milliman area relativity research. Billed charge estimates were developed for 30 days pre-transplant, physician services during transplant, 180 days post-transplant discharge and non-immunosuppressant drugs based on Milliman proprietary claim data. The report points out that ‘’estimated billed charges and resulting PMPM cost estimates may not be the actual amounts paid for transplant services. The use of case rates, discounts, or other negotiated reimbursement arrangements may result in significant reductions from billed charge levels. Actual charges will likely vary for private insurers, Medicare, or Medicaid’’ [34].

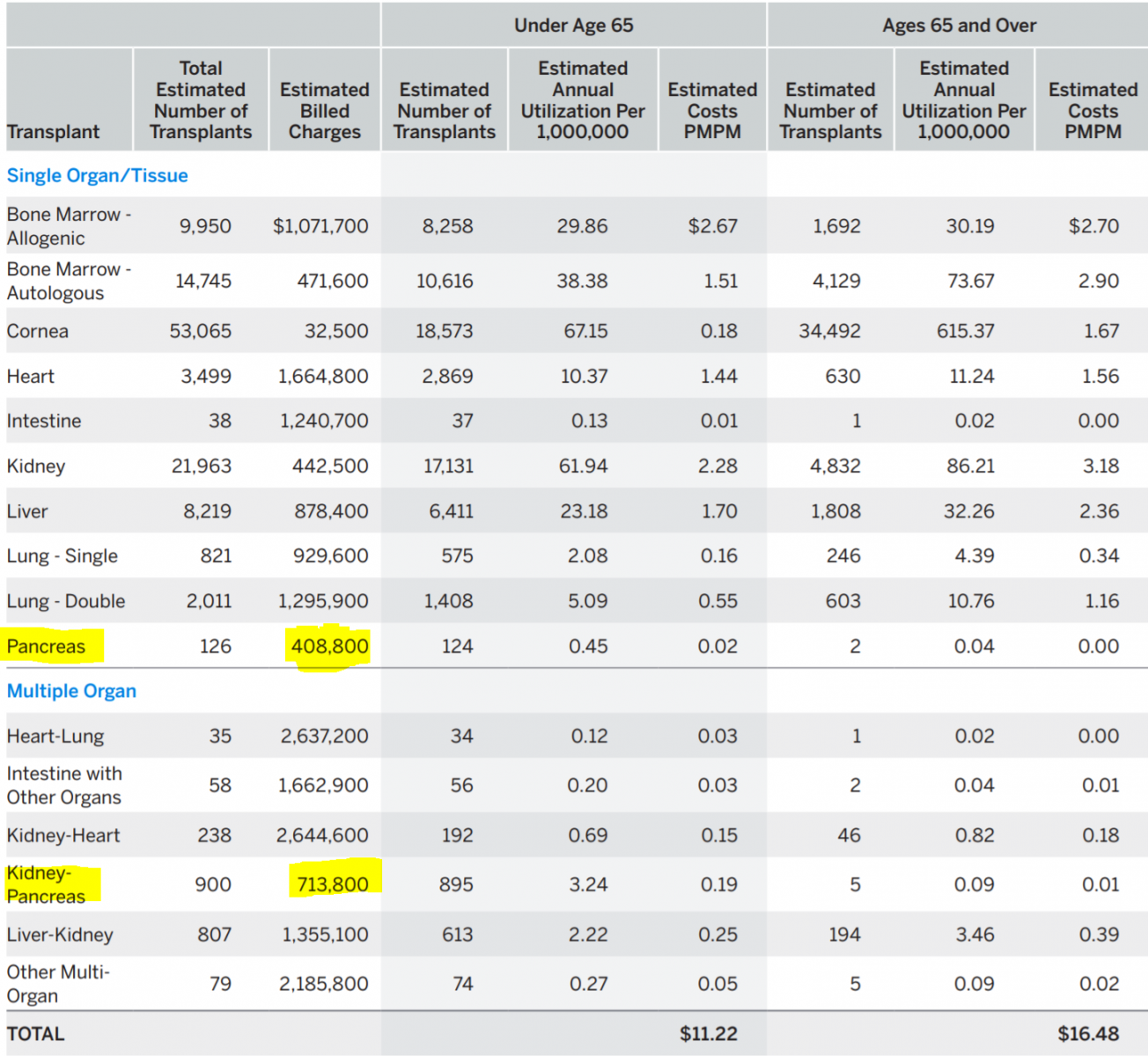

According to the 2020 report, billed charges for a solitary pancreas transplant amounted to $408,800, for a combined pancreas and kidney transplant to $713,800 (Table 1). For solitary organ transplants, the estimated billed charges for a pancreas were the lowest of all solid organ transplants, even lower than for a kidney transplant. For multiple organ transplants, the estimated billed charges for a pancreas and kidney were also the lowest (only about half of billed charges for a combined liver and kidney transplant). (34)

Table 1. Estimated U.S Average 2020 Transplant Costs PMPM [34]

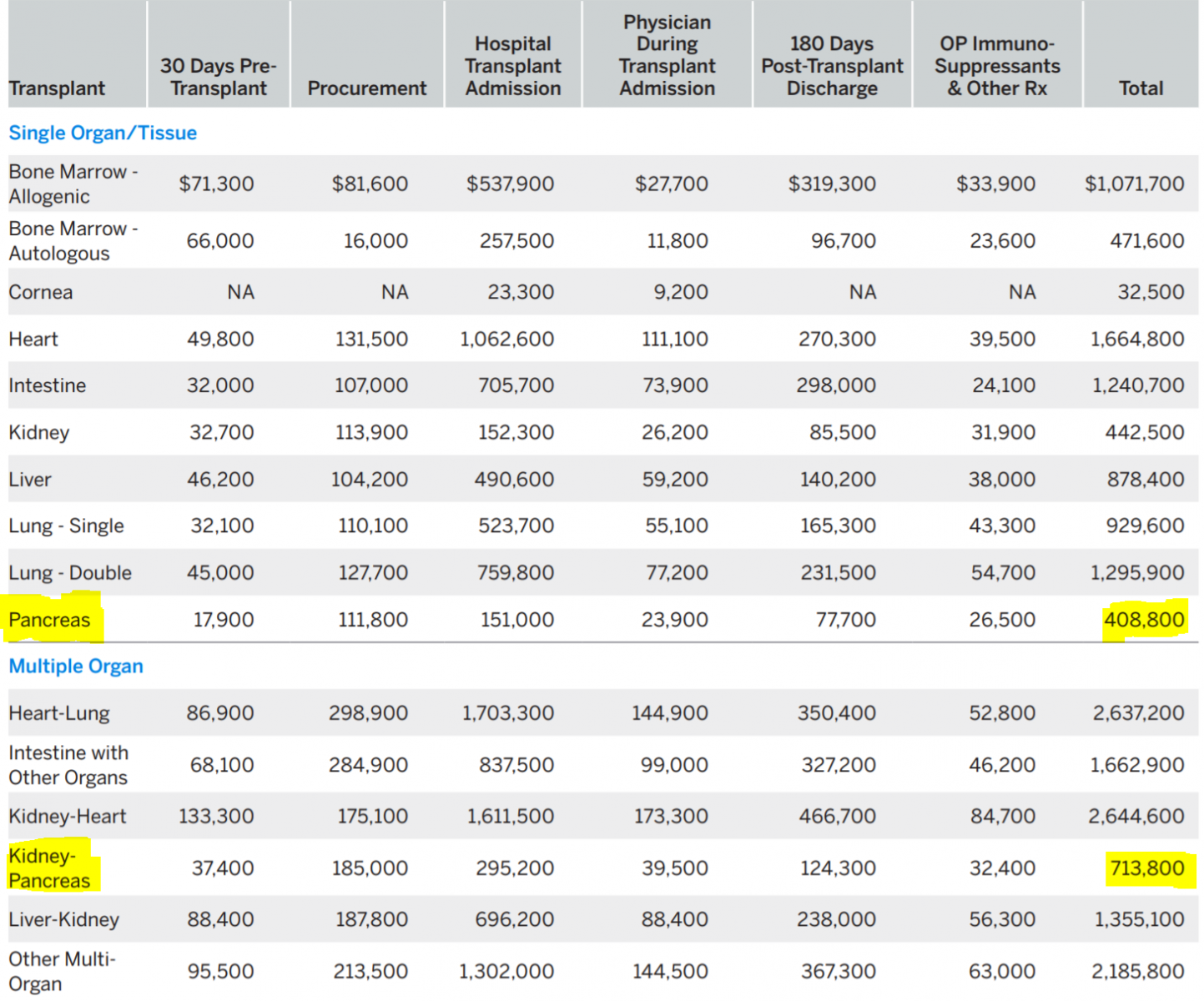

The report reveals some surprising findings. While the estimated billed charges for a pancreas transplant are the lowest of all solid organ transplants, the billed procurement charges are high in comparison (Table 2).

Table 2. Estimated U.S Average 2020 Billed charges Per Transplant [34]

For a solitary pancreas transplant, they are higher than for a single lung or the intestine; for a SPK, they are higher than for a heart-kidney and about the same as for a liver-kidney. The billed charges for ‘physician during transplant admission’ are by far the lowest of all solid organ transplants, even lower than for a kidney transplant. This finding is very surprising as the post-transplant care of a pancreas recipient is one of the most complexes of all transplants. Likewise, the billed charges for ‘hospital transplant admission’ are the lowest of all transplants, lower than for a kidney transplant. Pancreas transplant surgeons have long complained about inadequate reimbursement for bench preparation of the pancreas, the most complex of all transplants. These numbers confirm the surgeons’ sentiment. The discrepancy between very high organ acquisition (procurement) costs and low hospital and physician reimbursement results in unfavorable contribution and profit margins which, in part, explain the decade-long (2004-15) decline in pancreas transplantation [34].

CMS Transplant Coverage and Reimbursement Policies

The Centers for Medicare & Medicaid Services (CMS) have long reimbursed certified (pancreas) transplant” centers for costs associated with the acquisition of organs for transplant to Medicare beneficiaries. Hospitals claim and are reimbursed for these costs through submission of their Medicare Part A cost reports. Allowable organ acquisition costs include organ donor and recipient costs before hospital admission for the transplant operation (i.e., pretransplant services) and hospital inpatient costs associated with the donor. Medicare requires that these costs be reasonable; properly allocated among pretransplant, postransplant, nontransplant, and other activities; and supported by appropriate documentation. The Centers for Medicare & Medicaid Services (CMS) contracts with fiscal intermediaries to review hospital cost reports and determine the allowability of costs claimed” [35].

‘’To participate in the Medicare program, a certified transplant center (CTC) or organ procurement organization (OPO) must be a member of the Organ Procurement and Transplantation Network (OPTN). An OPO can be a hospital-based OPO (HOPO) or an independent OPO (IOPO)….Hospitals are required to notify the OPO designated for its service area of deaths or imminent deaths in its hospital. Organs may be procured by OPOs from CTCs, local community hospitals or other OPOs’’ [36].

In general, “there are two payment components for organ transplantation. Approved transplant centers are paid a Prospective Payment System (PPS) rate based on a Medicare Severity-Diagnosis Related Group (MS-DRG) rate for the actual organ transplant and they are also reimbursed for the reasonable and necessary costs associated with acquiring the organ (that is, organ acquisition costs).

CMS Reimbursement for Organ Acquisition Cost

’’Organ acquisition costs for heart, kidney, liver, lung, pancreas, and intestinal/multi-visceral transplantations incurred by approved transplant centers are treated as an adjustment (pass through payment) to the hospital's inpatient PPS (IPPS) payment. Applicable acquisition charges are submitted separately by revenue code 0811 (Acquisition of Body Components, Living Donor) or 0812 (Acquisition of Body Components, Deceased Donor) and are not included in the DRG-based payment for the transplant under the IPPS….To prevent potential overpayments, Medicare’s Fiscal Intermediary Shared System deducts organ acquisition charges billed with certain revenue codes (081X) from the total covered charges prior to sending an inpatient Type of Bill (TOB) to the IPPS pricer’’ [37,38].

Medicare organ acquisition reimbursement from the Medicare Cost Report (MCR) provides a significant revenue stream for transplant programs. It includes, but is not limited to, costs associated with candidate evaluation, maintenance on the list, deceased and living kidney donation and costs of pre-transplant staff. Medicare organ acquisition reimbursement is a fully loaded, cost-based reimbursement which can be as much as 80% of total reimbursement for kidney transplantation [39].

Medicare is the single largest payer for organ acquisition costs but only reimburses for its share of costs. In 2016, Medicare reimbursed CTCs $1.6B of approximately $3.3B (48%) claimed through the Medicare Cost Report [40].

With cost-based reimbursement, there is financial risk with over-reporting (as well as under-reporting) organ acquisition costs claimed for Medicare reimbursement. Further, without adequate controls and systems for appropriate documentation, there is an increased risk of non-compliance with CMS regulations and guidelines [39].

For those reasons, CMS has repeatedly complained about overpayment. In April of 2021, ‘’CMS issued its Fiscal Year 2022 Medicare Hospital Inpatient Prospective Payment System (IPPS) and Long Term Care Hospital (LTCH) Rates Proposed Rule (CMS-1752-P), in which it proposes several changes to organ acquisition payment policies that would enable Medicare to more accurately record and pay its share of organ acquisition costs. Sparked by the Office of Inspector General (OIG) concerns that some organ procurement organizations (OPOs) may have billed Medicare for unallowable expenditures and similar concerns from Congress regarding OPO financial management (which are the subject of a House Oversight Committee investigation), CMS intends that the new policy will "allow providers and stakeholders to more easily locate and understand organ acquisition payment policy, resulting in more accurate payment based on reasonable cost principles." The proposed rule affects organ acquisition payment policies for transplant hospitals, donor hospitals, and OPOs. Notably, if the proposed rule is implemented, CMS estimates substantial cost savings ($230 million in FY 2022, and $4.15 billion over ten years) and increased transparency and overall improvement in organ donation and transplantation’ [37,41].

These CMS rulings and their modifications reveal some the complexities of reimbursement.

The pancreas transplant community has long complained about the high Standard Acquisition Charges (SACs). Since there is very little ‘standard’ about SACs, Luskin et al. have proposed to better name SACs ‘Organ Acquisition Charges’ (OACs) as its components vary from organ to organ and from OPO to OPO [29]. High pancreas SACs or OACs have consistently been considered an impediment for more widespread application of pancreas transplantation. The reason for high pancreas SACs is the high pancreas discard rate after recovery, the highest discard rate of all organs (25% vs 19% for kidney, 10% for liver, 4% for lung and 1% for heart). Based on CMS cost-finding and reimbursement policies for organ procurement organizations (OPOs), this high level of intended-for-transplant but a not-transplanted pancreas has the effect of substantially raising OPO pancreas organ acquisition charges [29]. It has been suggested that high OACs have been a significant factor for the decline in pancreas transplant volume between 2004-2015.

Historically, in the early years, pancreas transplantation was frequently considered an investigational procedure. Insurance coverage policies were not uniform and often decided on a case-by-case basis. Initially, private insurers were the primary source of patient coverage [29].

For SPK, Medicare was paying for the kidney transplant portion of the hospital charges, but the pancreas transplant costs were either covered separately or simply not reimbursed. Beginning in July 1999, Medicare provided coverage for SPK for all patients with type 1 diabetes and end-stage renal disease. Not surprisingly, this change in coverage increased access to SPK for Medicare beneficiaries and increased the number of pancreas transplants. But, despite improved insurance coverage, the cost of the pancreas transplant procedure remains an issue today for the reasons outlined below [29].

‘Each OPO in the USA establishes an acquisition charge for each type of organ. This fee is paid to the OPO by the transplanting hospital for each organ it receives. Oversight of payments to OPOs is regulated by CMS as part of the End-Stage Renal Disease (ESRD) program. Although Medicare ESRD payments only cover renal transplants, the methodology proscribed by CMS in determining those payments impacts how the OPO charges transplant centers for all other organs’ including the pancreas. As already mentioned, ‘Medicare reimburses OPOs the reasonable cost of allowable services, with the definition of ‘reasonable’ and ‘allowable’ determined by CMS regulations and applied by private contractors (fiscal intermediaries) working under contract to CMS. Each year, OPOs are required to file a Medicare cost report that, using Medicare’s cost-finding methodology, assigns costs associated with renal procurement and distribution, extrarenal procurement and distribution, and tissue recovery.

Costs associated with a specific organ are assigned to that organ [29,42-44]. “Costs that relate to all organs such as donor serology or hospital operating room charges are assigned proportionately to all organs considered for recovery on a particular donor. For many donors, costs associated with assessing a particular organ’s suitability for transplant will be incurred, but the decision will be made not to recover that organ based on the clinical findings. Or an organ will be thought to be suitable for transplant, and an intraoperative finding will rule it out. However, the costs associated with assessing the organ still must be assigned to that organ’s cost center as OPOs only generate payment of an extrarenal organ OAC if the organ is actually transplanted. However, the costs associated with organs evaluated but not recovered, and/or organs recovered and discarded also must be covered by the OAC (in addition to the direct costs associated with each organ, general costs and OPO overhead costs are assigned proportionately’’ [29].

‘’This CMS Ruling shifted costs to any organ that was ruled out intraoperatively. Pancreas cost was impacted the most due to the large number of pancreases that are ruled out during the recovery procedure’’. If a pancreas was actually recovered and transplanted in, for example, less than 50 % of the cases where the OPO went to the operating room with the intent to transplant the pancreas, each pancreas that was actually transplanted, had to be assigned about or more than double the overhead and indirect costs.

The CMS ruling had an even greater impact on islet transplantation. ‘’The intent-to-recover rule also applies to pancreas for research. If the pancreas was intended to be recovered for transplant when the recovery began, and subsequently was recovered only for research, or was recovered for transplant but ultimately discarded, the intent rule applies. Only if the pancreas was recovered specifically with the intent to use it in a research protocol, then it is excluded from the CMS calculation used to determine theallocation of costs to each organ’’ [29].

Luskin and et al. point out some conflicting CMS incentives: ‘’OPOs are encouraged to recover, or at least consider for recovery, every organ where there is some potential for transplant. Transplant centers’ performance is measured on the outcomes of the transplants they actually perform. While there is some adjustment for donor characteristics, most transplant centers believe the adjustment is inadequate and thus are reluctant to transplant organs where there is a higher perceived potential for graft failure. This is particularly true for pancreas where most programs have relatively low transplant volumes, and a single graft failure is more likely to put them into non-compliance’’ [29].

In summary, pancreases OACs are high due to a number of complex issues:

- The disparity between the number of organs recovered (or intended to be recovered) and the number of pancreas actually transplanted;

- The CMS cost-finding methodology requiring assignment of full overhead and indirect costs to all pancreases where there was an intent to recover for transplantation (even if the organ was not actually recovered);

- Conflicting CMS performance metrics for OPOs and transplant centers that encourage OPOs to recover every organ possible for transplant, but also encourage transplant centers to be cautious in the organs they actually transplant to avoid being penalized for poor patient outcomes [29].

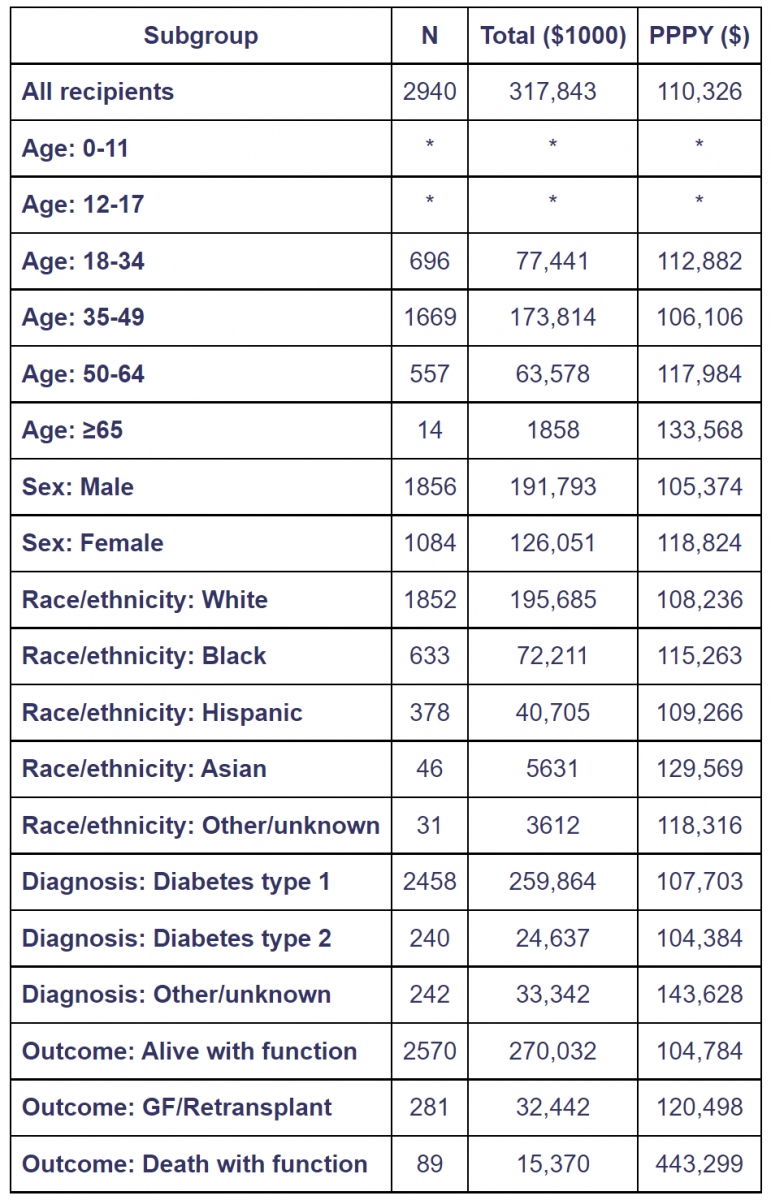

Table 3. Total and per person per year Medicare costs of pancreas transplant recipients in year 1 posttransplant [45].

Costs for recipients with Medicare as primary payer at the time of transplant, 2008-2013.Year -1costs include the transplant hospitalization.Costs incurred after transplant failures are excluded. Total costs are given in $1000units and per person per year (PPPY) costs in $units.Cohort includes pancreas transplants with and without kidney.Values for cells with 9or fewer recipients are suppressed. GF, graft failure.

CMS pancreas transplant cost data

Medicare costs vary for pancreas transplant recipients by outcome: survival with graft function, survival with graft failure, and death [45].

Complications after pancreas transplantation are more common than after most other types of organ transplants. Reducing the rate of complications not only reduces overall costs, but benefits all parties (patient, physician, payer and medical center) from quality improvement. It is obvious that payers have a financial interest in pancreas transplant surgical quality initiatives [46].

According to the OPTN/SRTR 2016 Annual Data Report, the average reimbursement for pancreas recipients from transplant through the first year posttransplant, with primary Medicare coverage at the time of pancreas transplant in 2008-2013, was $110,000 (Table 3) [45].

“Average per-person per-year (PPPY) reimbursement for recipients who survived the first year posttransplant with a functioning graft was $105,000. This rose to $120,000 for recipients who survived pancreas failure, 115% of the cost for those who ended the year alive with graft function. Average PPPY reimbursement for recipients who died with function in the first year was $443,000, 423% of the cost for those who ended the year alive with function [45].

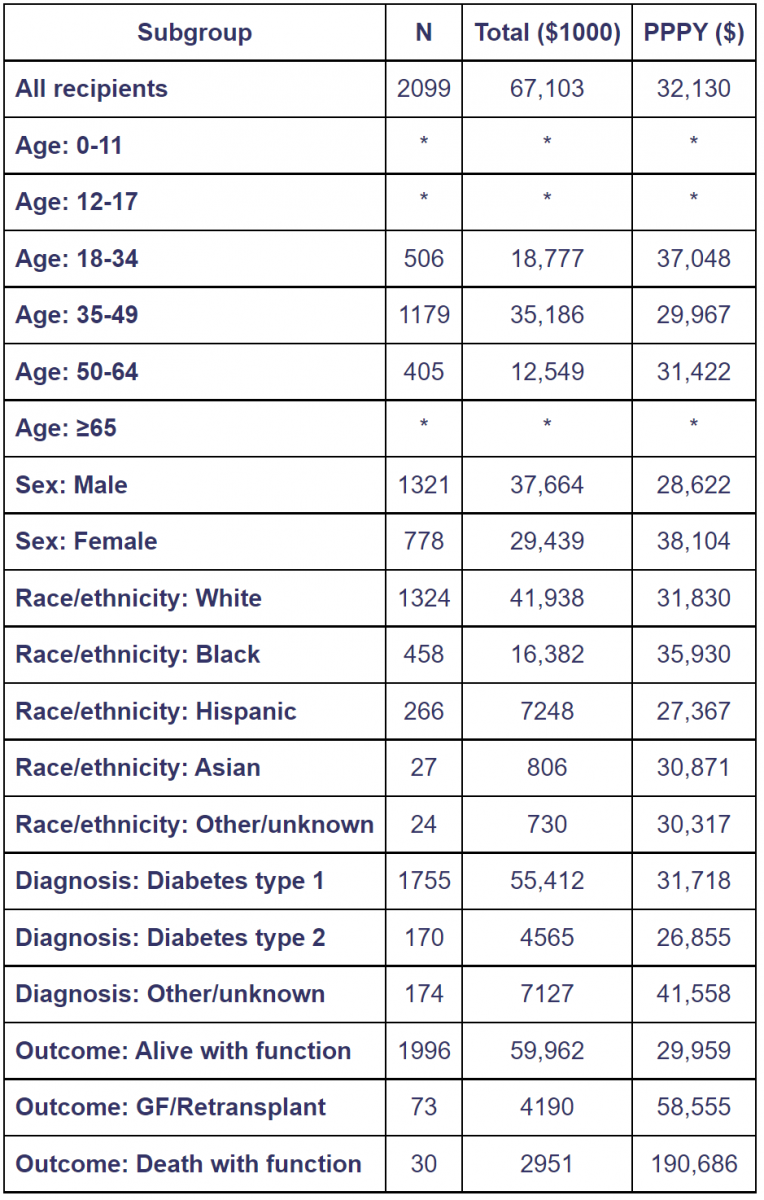

Average per-patient costs in the second year posttransplant were $32,000, 35% less than the $49,000 average cost in the year preceding transplant. Costs by outcome were much less in the second year posttransplant (Table 4); however, relative costs were higher for recipients who died and/or experienced graft failure. Relative to $30,000 average PPPY expenditure for recipients who were alive with function at the end of the second year, $59,000 PPPY (195%) was spent on those who experienced pancreas failure, and $191,000 PPPY (636%) on those who died with function [45].

Total Medicare reimbursement during the first year posttransplant was $318 million (Table 3). Of this, expenditures by outcome were $270 million (85%) for recipients alive with a functioning graft, $32 million (10%) for those who survived pancreas failure and $15 million (4.8%) for those who died with function. Proportions were: 87% of recipients alive with a functioning graft, 10% survived graft failure, and 3.0% died with function. Overall, the 13% of recipients who died and/or experienced graft failure within the first year posttransplant accounted for 15% of total costs. The 4.9% of recipients who died and/or experienced graft failure within the second year posttransplant accounted for 11% of total costs (Table 4). Death with function accounted for 4.4% of costs, but only 1.4% of recipients, due to their relatively high cost’’ [45].

Table 4. Total and per person per year Medicare costs of pancreas transplant recipients in year 2 posttransplant [45].

Costs for recipients with Medicare as primary payer at the time of transplant, 2008-2012. Year 2 is from day 366 to day 730 posttransplant. Costs incurred after transplant failure are excluded. Total costs are given in $1000 units per person per year (PPPY) costs in $ units. Cohort includes pancreas transplants with and without kindly. Values for cells with 9 or fewer ecipients are suppressed. GF, graft failure.

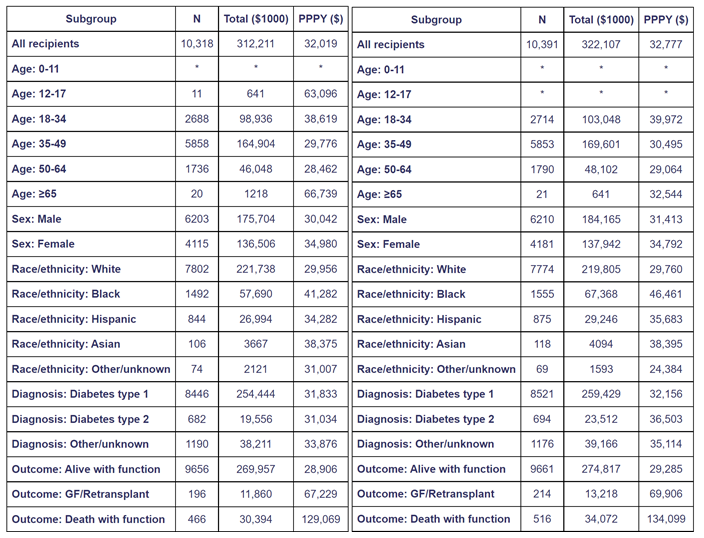

‘’Total Medicare expenditures in 2013 and 2014 for all pancreas transplant recipients with graft function at the beginning of the year for whom Medicare made any payment during the year are shown in Table 5. Average PPPY and total Medicare reimbursement were $32,000 and $312 million in 2013 and $33,0000 and $322 million in 2014. In 2013, 6.4% of recipients died and/or experienced graft failure, and 7.0% in 2014; these recipients accounted for 14% of Medicare reimbursement in 2013 and 15% in 2014. Compared with recipients in the second year posttransplant (Table 2), PPPY costs averaged over 2013 and 2014 were 2.9% lower for those alive with function, 17% higher for those experiencing graft failure, and 31% lower for those who died with function” [45].

Table 5. Total and per-person-per-year (PPPY) calendar-year Medicare costs of pancreas transplant recipients, 2013 (right) and 2014 (left) [45].

Costs paid by Medicare in 2013 for recipients alive with graft function in 2013, regardless of Medicare eligibility at the time of transplant. Costs incurred after transplant failure are excluded. Total costs are given in $1000 units per person per year (PPPY) costs in $ units. Cohort includes pancreas transplants with and without kindly. Values for cells with 9 or fewer recipients are suppressed. GF, graft failure.

INSURANCE PROVIDERS AND PANCREAS TRANSPLANT COVERAGE

A pancreas transplant typically is covered by health insurance, although insurers may require a patient to get the transplant at a specific transplant center. The process starts when a patient is referred to a transplant center by his or her doctor and added to a national waiting list.

Public insurance includes (among others) Medicare, Medicaid, Department of Veterans Affairs coverage, TRICARE (for civilian Armed Forces personnel and retirees), Children’s Health Insurance Program (CHIP), and Indian Health Service (IHS). Private insurance examples include a group health plan (HMO, PPO, POS, EPO), employer-based plan, coverage under the Affordable Care Act, or individual health insurance plan.

CMS

Medicare Part A (hospital coverage) generally covers a pancreas transplant under certain conditions at a Medicare-certified facility. Usually, Medicare covers the pancreas transplant for end-stage renal disease (ESRD) patients if it is done at the same time as a kidney transplant (SPK) or if it is done after a kidney transplant (PAK). In rare cases Medicare may cover a pancreas transplants (PTA) even if a kidney transplant is not needed [47,48]

Only since April 2006, pancreas transplants alone (PTA) are reasonable and necessary for Medicare beneficiaries in the following limited circumstances [49]:

- PTA will be limited to those facilities that are Medicare-approved for kidney transplantation;

- Patients must have a diagnosis of type I diabetes:

Patient with diabetes must be beta cell autoantibody positive; or patient must demonstrate insulinopenia defined as a fasting C-peptide level that is less than or equal to 110% of the lower limit of normal of the laboratory's measurement method. Fasting C-peptide levels will only be considered valid with a concurrently obtained fasting glucose ≤ 225 mg/dL;

- Patients must have a history of medically uncontrollable labile (brittle) insulin-dependent diabetes mellitus with documented recurrent, severe, acutely life-threatening metabolic complications that require hospitalization. Aforementioned complications include frequent hypoglycemia unawareness or recurring severe ketoacidosis, or recurring severe hypoglycemic attacks [50];

- Patients must have been optimally and intensively managed by an endocrinologist for at least 12 months with the most medically recognized advanced insulin formulations and delivery systems;

- Patients must have the emotional and mental capacity to understand the significant risks associated with surgery and to effectively manage the lifelong need for immunosuppression; and,

- Patients must otherwise be a suitable candidate for transplantation.

Medicare Part B (medical insurance) generally covers doctor services for a pancreas transplant. A pancreas transplant involves medical care before, during, and after the surgery. Medicare generally covers [51]:

- Tests, labs and exams before the pancreas transplant

- Procurement of a pancreas

- The actual pancreas transplant surgery

- Follow-up care

- Beginning in 2023, the Comprehensive Immunosuppressive Drug Coverage for Kidney Transplant Patients Act (H.R. 5534; also known as the Immuno bill) will add a new Medicare option to provide lifetime coverage of immunosuppressive drugs for kidney transplant recipients (SPK, PAK). Before this, patients lost coverage for immunosuppressive medications 36 months post-transplant. Many patients struggled to pay for these drugs, leading to rationing or stopping taking the medications entirely, either of which almost always resulted in the transplant failing. Many others did not even try to get a transplant for fear of not being able to afford their immunosuppressive drugs 36 months after their transplant [51]. Although the Comprehensive Immunosuppressive Drug Coverage for Kidney Transplant Patients Act of 2019, extends drug coverage to all patients with a kidney transplant, patients younger than 65 years pay a monthly premium of $243 in the first year of the program; the premium would increase gradually to about $345 per month by 2030 [52]

- Medicare Part D prescription drug coverage may cover for other types of prescription drugs needed after a pancreas transplant [29,33]. However, Lushin et al. documented in a multicenter case series Medicare Part D plan denials of immunosuppressant drug coverage for organ transplant recipients when these medications are prescribed off-label [53].

For a pancreas transplant under Medicare the patient generally pays:

20% of the Medicare-approved amount for doctor’s services and the Part B deductible applies and various amounts for the transplant facility charges including Medicare Part A coinsurance. A Medicare Supplement plan can help you pay for health care costs that Original Medicare (Part A and Part B) doesn’t cover, such as copayments, coinsurance, and deductibles [33,47,48].

Private Health Insurance Providers

Most private health insurance providers cover the 3 major types of pancreas transplants (SPK, PAK, PTA). Historically, private health insurance providers have covered the costs for pancreas transplants based on then-available scientific evidence long before CMS started providing coverage.

Payment arrangements by private health insurance providers vary widely and depend on many factors including center size, program volume and outcomes. Contracts and payment arrangements are usually kept confidential and a national database for comparison does not exist. In fact, publication of complete lists of prices negotiated between health care providers and private insurers has met strong resistance because it supposedly “undermines competitive negotiations”: such attempts have even been called unconstitutional by the insurers’ trade association [54].

While payment arrangements vary widely between individual private health insurance providers, patients generally have to be prepared for medical out-of-pocket expenses (eg, insurance premiums, co-pays and deductibles) as well as “non-medical” expenses (eg, temporary lodging and meals for family members during and after the transplant, transportation to and from the transplant center for follow-up visits, childcare costs, and possible loss of income while out of work for the transplant).

Policies and procedure manuals for pancreas transplantation by some of the major private health insurance providers are referenced below [28,55-60]

COSTS FOR PANCREAS vs ISLET TRANSPLANTS

In contrast to pancreas transplantation, the costs for islet transplantation are even less transparent. One of the reasons is that the number of islet transplants is much smaller, and the outcome is less favorable. Although islet transplantation can result in restoration of hypoglycemia awareness and protection from severe hypoglycemic episodes, safety concerns have been raised related to the infusion procedure and immunosuppression, including bleeding and decreased renal function [61]

CMS still does not provide regular reimbursement for clinical islet transplants. One of the main issues is that, in the US, islets are considered biologic drugs and "more than minimally manipulated" human cell and tissue products (HCT/Ps). In contrast, across the world, human islets are defined as "minimally manipulated tissue" and not regulated as a drug, which has led to islet transplantation becoming a standard-of-care procedure for selected patients with type 1 diabetes mellitus. This regulatory distinction has impeded patient access to islets for transplantation in the US. As a result only 11 patients underwent allo-ITx in the US between 2016 and 2019, and all as investigational procedures in the settings of clinical trials [62].

Another hurdle is the CMS cost-finding methodology requiring assignment of full overhead and indirect costs to all pancreases where there was intent to recover for islet transplantation (even if the organ was not actually recovered or used for islet transplantation). As already mentioned, the impact of the change is particularly severe on islet cell transplantation where there is a ‘need to complete the manufacturing process for islets before suitability and transplant intent of the pancreata involved can be determined’, and a patient may require islet infusions from multiple donors [29]. Suggestions have been made as to how CMS might modify its cost-finding and reimbursement policies, but for now, pancreas recovered for islet cell isolation/transplantation are treated the same as pancreas recovered for whole-organ transplant.

Only one single-center study compared costs associated with pancreas vs islet transplantation and inpatient management [63]. This study included 15 PTA and 10 ITA recipients. In the ITA group, the mean normalized cost for each first islet transplant was $99,194. Four of 10 islet recipients required a second islet transplant, doubling their mean transplant costs to $198,389 per patient. When the additional expense of the second transplants was included in the entire ITA group costs, the final mean cost per patient increased to $138,872. There were no inpatient hospitalizations for transplant-related complications in the first 4 years after transplant in the ITA group. In the PTA group, the mean normalized transplant and hospitalization cost was $109,041. Surgical and medication-related complications requiring inpatient treatment occurred in eight of 14 patients within 4 years following transplantation, giving an additional mean cost of $25,707 per patient. Incorporating this additional expense increased the overall mean cost per patient to $134,748.08. There was no difference in overall costs over a 4-year time period [63].

CONCLUSIONS

In the Unites States, the economic and financial aspects of pancreas transplantation are not transparent and national datasets do not exist.

Pancreas transplantation is one of the most complex hospital service lines and requires collaboration between several departments as well as physician input to achieve financial success. Key departments include Reimbursement (Medicare Cost Report preparation and submission), Revenue Cycle (patient registration, hospital and physician billing), Accounting Cycle (accounting for direct organ acquisition costs and revenue), Managed Care Contracting (obtaining reimbursement from non-Medicare payers), and Transplant Administration. (38) Under the current system, pancreas acquisition costs are too high and payment to hospitals and physicians is too low to achieve positive contribution and profit margins. More widespread application of pancreas transplantation is only possible if the financial and economic aspects remain on the forefront of physicians and administrators and positive changes can be implemented.

REFERENCES

- Gruessner RWG. (2023). Economic and Insurance Issues. In: Transplantation of the Pancreas. 2nd Edition. Editors: Gruessner RWG, Gruessner AC. Cham: Springer International Publishing. Chapter 79. pp 1087-1100.

- https://www.diabetes.org/resources/statistics/statistics-about-diabetes

- https://www.cdc.gov/diabetes/data/statistics-report/index.html

- https://www.who.int/news-room/fact-sheets/detail/diabetes

- https://care.diabetesjournals.org/content/41/5/929

- American Diabetes Association. (2018). Economic Costs of Diabetes in the U.S. in 2017. Diabetes Care. 41(5):917-928.

- https://care.diabetesjournals.org/content/41/5/929

- https://www.diabetes.org/resources/statistics/cost-diabetes

- Simeone JC, Shah S, Ganz ML, Sullivan S, Koralova A, LeGrand J, et al. (2020). Healthcare resource utilization and cost among patients with type 1 diabetes in the United States. J Manag Care Spec Pharm. 26(11):1399-1410.

- Herman WH, Braffett BH, Kuo S, Lee JM, Brandle M, Jacobson AM, et al. (2018). The 30-year cost-effectiveness of alternative strategies to achieve excellent glycemic control in type 1 diabetes: An economic simulation informed by the results of the diabetes control and complications trial/epidemiology of diabetes interventions and complications (DCCT/EDIC). J Diabetes Complications. 32(10):934-939.

- Joish VN, Zhou FL, Preblick R, Lin D, Deshpande M, Verma S, et al. (2020). Estimation of Annual Health Care Costs for Adults with Type 1 Diabetes in the United States. J Manag Care Spec Pharm. 26(3):311-318.

- https://care.diabetesjournals.org/content/41/5/929

- Sussman M, Benner J, Haller MJ, Rewers M, Griffiths R. (2020). Estimated Lifetime Economic Burden of Type 1 Diabetes. Diabetes Technol Ther. 22(2):121-130.

- https://www.americanactionforum.org/research/insulin-cost-and-pricing-trends/

- https://care.diabetesjournals.org/content/diacare/suppl/2018/03/20/dci18-0007.DC1/DCi180007SupplementaryData.pdf

- Riddle MC, Herman WH. (2018). The Cost of Diabetes Care-An Elephant in the Room. Diabetes Care. 41(5):929-932.

- https://healthcostinstitute.org/diabetes-and-insulin/spending-on-individuals-with-type-1-diabetes-and-the-role-of-rapidly-increasing-insulin-prices

- https://www.reuters.com/article/us-usa-healthcare-diabetes-cost/u-s-insulin-costs-per-patient-nearly-doubled-from-2012-to-2016-study-idUSKCN1PG136

- Rajkumar SV. (2020). The High Cost of Insulin in the United States: An Urgent Call to Action. Mayo Clin Proc. 95(1):22-28.

- The Lancet Diabetes Endocrinology. (2021). Insulin at 100: time for action on costs. Lancet Diabetes Endocrinol. 9(3):127.

- http://main.diabetes.org/dorg/PDFs/2018-insulin-affordability-survey.pdf

- https://www.cms.gov/newsroom/press-releases/president-trump-announces-lower-out-pocket-insulin-costs-medicares-seniors

- Crossen S, Xing G, Hoch JS. (2020). Changing costs of type 1 diabetes care among US children and adolescents. Pediatr Diabetes. 21(4):644-648.

- Bommer C, Sagalova V, Heesemann E, Manne-Goehler J, Atun R, Bärnighausen T, et al. (2018). Global economic burden of diabetes in adults: projections from 2015 to 2030. Diabetes Care. 41(5):963-970.

- Kähm K, Laxy M, Schneider U, Rogowski WH, Lhachimi SK, Holle R. (2018). Health care costs associated with incident complications in patients with type 2 diabetes in Germany. Diabetes Care. 41(5):971-978.

- Gruessner S, Gruessner A. (2017). Employment pattern after pancreas transplantation–Facts and Risk factors- A registry analysis. The Review of Diab Studies. 14(1):177.

- Boudreau R, Hodgson A. (2007). Pancreas transplantation to restore glucose control: review of clinical and economic evidence. Canadian Agency for Drugs and Technologies in Health. Available at: http://www.cadth.ca.

- Jarl J, Gerdtham UG. (2012). Economic evaluations of organ transplantation: a systematic literature review. Nord J Health Econ. 1:61-82.

- Luskin RS, Washburn DL, Gunderson S. (2015). The Economic Aspects of Pancreas Transplant: Why Is the Organ Acquisition Charge So High? Curr Transpl Rep. 2:164-168.

- https://health.costhelper.com/pancreas-transplant-cost.html

- www.transplantliving.org/before-the-transplant/financing-a-transplant/the-costs/

- www.kidney.org/atoz/content/pancreastx.cfm

- https://www.planprescriber.com/medicare-coverage/does-medicare-cover-a-pancreas-transplant/

- https://milliman-cdn.azureedge.net/-/media/milliman/pdfs/articles/2020-us-organ-tissue-transplants.ashx

- https://oig.hhs.gov/oas/reports/region9/90500034A.pdf

- https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R471PR1.pdf

- https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM11087.pdf

- https://www.tricare-west.com/content/hnfs/home/tw/prov/res/provider_news/archive/2019/organ-acquisition-services-reimbursement-.html

- https://atcmeetingabstracts.com/abstract/comparative-review-of-adult-kidney-transplant-medicare-cost-report-reimbursement-in-u-s-transplant-hospitals/

- https://www.organdonationalliance.org/insight/medicare-reimbursement-for-organ-acquisition-costs/

- https://www.jdsupra.com/legalnews/newly-proposed-rule-regarding-organ-2779512/

- https://www.costreportdata.com/instructions/Instr_D60.pdf

- Schnitzler MA, Skeans MA, Axelrod DA, Lentine KL, Randall HB, Snyder JJ, et al. (2018). OPTN/SRTR 2016 Annual Data Report: Economics. Am J Transplant. 18(Suppl 1):464-503.

- https://www.costreportdata.com/instructions/Instr_D401.pdf

- https://srtr.transplant.hrsa.gov/annual_reports/2016/Economics.aspx

- Cohn JA, Englesbe MJ, Ads YM, Paruch JL, Pelletier SJ, Welling TH, et al. (2007). Financial implications of pancreas transplant complications: a business case for quality improvement. Am J Transplant. 7(6):1656-1660.

- https://www.medicare.gov/coverage/pancreas-transplants

- https://www.medicare.org/articles/does-medicare-cover-a-pancreas-transplant/

- https://www.cms.gov/medicare-coverage-database/details/ncd-details.aspx?ncdid=107&ver=3

- Gruessner RWG, Gruessner AC. (2023). Pancreas Transplantation Alone for Brittle Diabetes Mellitus. ES J Case Rep. 4(2):1044.

- https://www.kidney.org/atoz/content/faq-expanded-medicare-coverage-immunosuppressive-drugs-kidney-transplant-recipients

- https://www.healio.com/news/nephrology/20201210/us-house-of-representatives-approves-bill-offering-lifetime-transplant-drug-coverage

- Lushin EN, McDermott JK, Truax C, Lourenco LM, Mariski M, Melaragno JI, et al. (2021). A multicenter case series documenting Medicare Part D plan denials of immunosuppressant drug coverage for organ transplant recipients. Am J Transplant. 21(2):889-896.

- https://www.nytimes.com/interactive/2021/08/22/upshot/hospital-prices.html

- https://www.uhcprovider.com/content/dam/provider/docs/public/policies/medadv-coverage-sum/transplants-organ-tissue.pdf

- https://www.premera.com/documents/044192.pdf

- https://corp.mhplan.com/ContentDocuments/default.aspx?x=rrbdKSk/mp5/sB2wasdoN2OFyjSyqvbO/uDqFQBgeAmdSQ0Pr1+/Qzhy4DAoKspJxEKy7IBBOjcTPpYYFrR+0Q==

- https://www.bmchp.org/-/media/c085ddd2a29c43d992c03ab0bf5f6aaa.ashx

- https://www.molinahealthcare.com/providers/il/duals/resource/~/media/Molina/PublicWebsite/PDF/providers/wa/medicaid/resource/pancreas-transplantprocedures-mcp017.pdf

- http://www.med.umich.edu/pdf/kidney-transplant/Financial-Information.pdf

- Hering BJ, Clarke WR, Bridges ND, Eggerman TL, Alejandro R, Bellin MD, et al. (2016). Phase 3 trial of transplantation of human islets in type 1 diabetes complicated by severe hypoglycemia. Diabetes care. 39(7):1230-1240. 60a

- Witkowski P, Philipson LH, Kaufman DB, Ratner LE, et al. (2021). The demise of islet allotransplantation in the United States: A call for an urgent regulatory update. Am J Transplant. 21(4):1365-1375.

- Moassesfar S, Masharani U, Frassetto LA, Szot GL, Tavakol M, Stock PG, et al. (2016). A Comparative Analysis of the Safety, Efficacy, and Cost of Islet Versus Pancreas Transplantation in Nonuremic Patients With Type 1 Diabetes. Am J Transplant. 16(2):518-526.